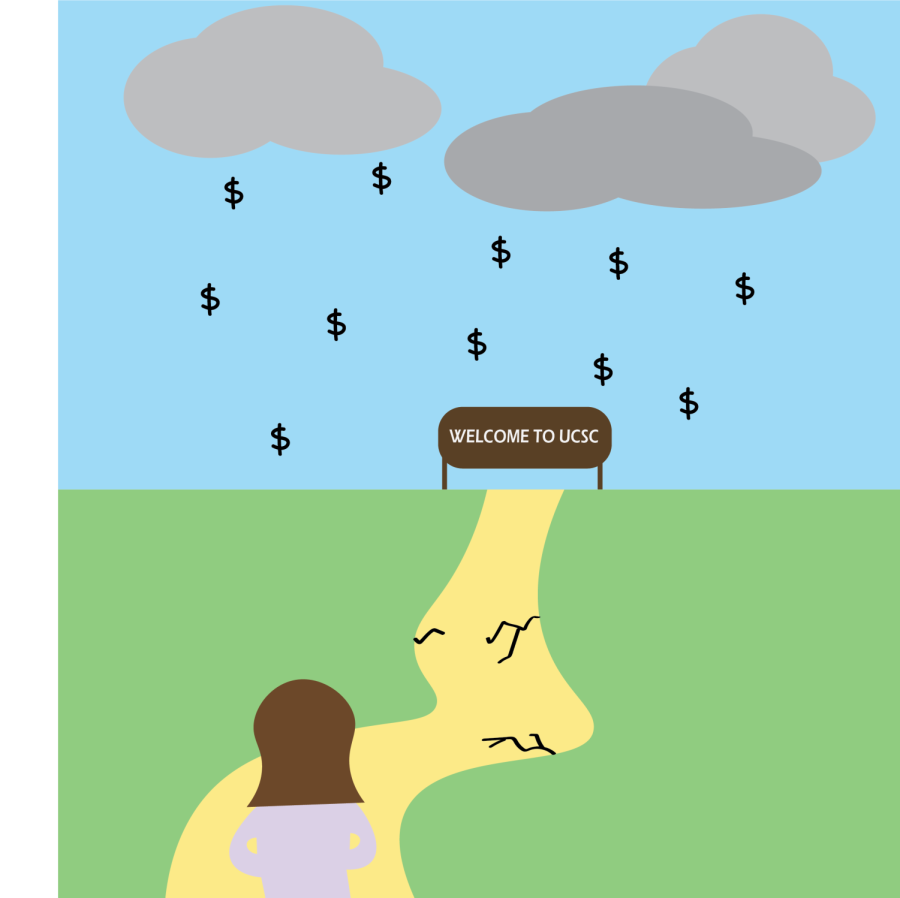

A hard road to success

Dealing with the next step of getting into UCSC

By the time I was eight years old, I knew that I would be going to college. Ignoring the fact that my parents gave me no choice but to go, I was eager to consider college as an opportunity to further my interests in animal science. As an eight-year-old, I was naïve in my ideas about what it takes to get into and stay in college.

Good grades: check. Extracurricular activities: check. Volunteer hours: check. Money: …

The once yellow brick road to college crumbled before my eyes as I looked through the University of California, Santa Cruz website. More specifically, the cost of tuition, room and board and additional costs. In some ways, the good grades, extracurricular activities and volunteer hours allowed me to receive grants and a few other financial reliefs for the expenses of college. However, they are not nearly enough to fund my entire college education. As the last resort, student loans are the only way to pay for college in the next four years.

According to the article, “Current Student Loan Interest Rates and How They Work,” written by Anna Helhoski and published by Nerdwallet, “the federal student loan interest rate for undergraduates is 3.73% for the 2021-22 school year. Federal rates for unsubsidized graduate student loans and parent loans are higher—5.28% and 6.28%, respectively.” For a short while, student loans make it possible for students to pursue a college degree. Nonetheless, the next 20 years of a person’s life after college is obligated to pay off the student loans which also include a high-interest rate as reported by Helhoski.

In another article, “It’s time to get an education on student loan options,” written by Ilana Polyak and published by CNBC, “Seven out of 10 college seniors finished their undergraduate degrees with loans, and the average load was $28,400 in 2013, reported the Institute for College Access & Success.” It’s crazy to think that many students entering college are allowed to take out tens of thousands of dollars in loans whilst learning how to survive in the world as an adult.

For a small majority of college students, they are lucky enough to not have to worry about college finances. However, the reality for low and middle-income students often includes scouring the internet for scholarships, grants, loans and even jobs. Even after applying for programs like the Free Application for Federal Student Aid and Extended Opportunity Program & Services, students still have a chance of being rejected for financial aid.

Money is only one out of the many obstacles for students to reach the end of the yellow brick road. Thankfully, at Bonita Vista High counselors are available to provide resources regarding financial aid opportunities. One of the biggest financial aid resources provided is a Scholarship Bulletin—a Google Doc with a long list of scholarships for students. I have resorted to this document many times to find scholarships specific to my personal interests, situation and eligibility.

College shouldn’t be as hard to finance as it currently is, but until a change is made it’s crucial that students take advantage of the resources made available to them and find ways to finance their education. There is still work to be done when it comes to taking the next step to higher education, but I know all will be rewarded by the end of the yellow brick road.

Howdy! Currently, I am a senior at Bonita Vista High and finishing my fourth year on the Crusader staff. Now, I am co-Editor in Chief of the Crusader,...